Coronavirus Update: May 29, 2020

by Jason Gunkel CFP® CFA CAP® Chief Investment Officer | May 29, 2020

The U.S. stock market (as represented by the S&P 500 Index) is on pace for a positive week with it being up 2.5% through Thursday. This has continued the market rally that began in April with the market up 17% over the past two months.

Some investors have been surprised by the market recovery during which dismal economic news and unemployment numbers continue to be reported. Another 2.1 million people filed for unemployment benefits last week which brings the total number of jobless claims over 40 million for the past 10 weeks.

The Bureau of Labor Statistics will release their May jobs report in early June and the unemployment rate is expected to be just under 20%, according to Yahoo Finance. The speed of the economic recovery largely depends on how quickly the unemployment rate drops. The unemployment rate could be close to peaking, but it could still be around 8% in late 2021, according to Goldman Sachs. That would seem to indicate we are heading toward a “U” or “swoosh” shaped recovery, as explained in the May 15 coronavirus update article.

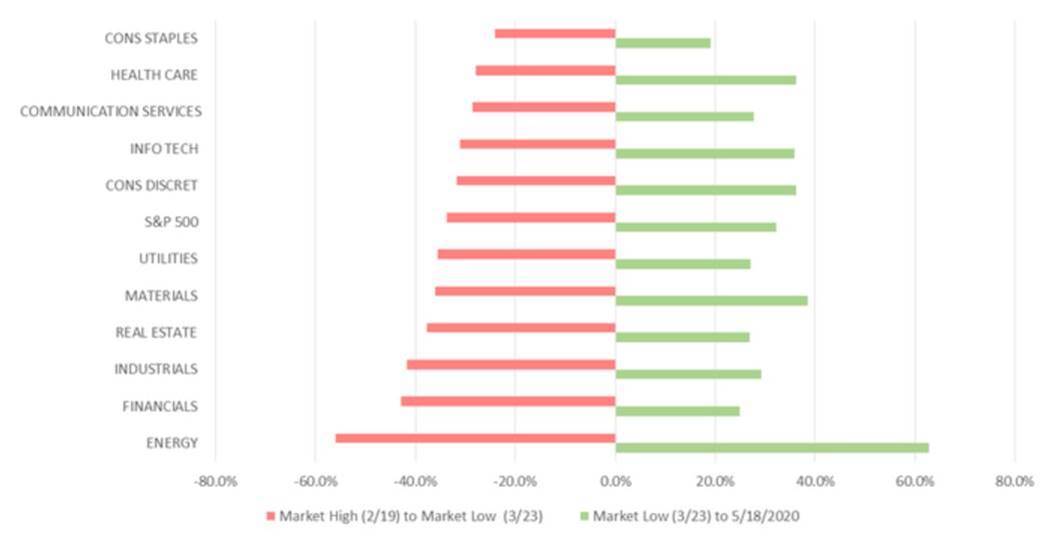

We believe the main reasons the market has rallied are the stimulus programs by the Federal Reserve and Congress along with optimism about the economy reopening. However, it is interesting to look at how the returns have not been broad-based across different sectors of the market.

The sectors that have been positively affected by the virus have performed far better. Three of those sectors including Technology, Health Care, and Communication Services, now make up over 50% of the S&P 500 Index. Just 10 years ago, they constituted only about 30% of the index according to Schwab Market Research. Those three sectors of the S&P 500 Index have averaged a positive return of almost 2% year to date.

Technology and Communication Services have benefited from people using more of their services while working remotely and social distancing at home. Health Care has benefited from more use of medical equipment and hopes that pharmaceutical and biotechnology companies will create a coronavirus vaccine and cure.

On the other hand, “cyclical” sectors that are more affected by economic downturns, including Financial Services, Real Estate, and Industrials, have fared much worse. Their average return as part of the S&P 500 has been down 15% year to date.

Financials suffered as the demand for loans has fallen, low long-term interest rates make lending less profitable, and higher defaults on loans are expected. Commercial real estate is under duress as many retailers cannot pay rent and the demand for office space could be lower in the future if more people work remotely. The Industrials sector, including travel-related companies such as the airlines, will continue to suffer until people become more comfortable with commercial travel.

It makes this market rally more unique in that the cyclical sectors mentioned above, which tend to outperform during recoveries, have failed to do so. The chart below illustrates this point with the year-to-date returns of sectors during both the downturn and recovery periods.

Source: Charles Schwab. Returns represent the sector of the S&P 500 Index. Past performance is no guarantee of future results.

The lack of a larger rally from more cyclical sectors seems to indicate that the current market recovery could be more speculative in nature. When investors become more confident that the economy has turned the corner, they will likely push up the prices of more cyclical companies which could be a sign that a sustainable and broad-based market recovery is on the horizon.