Coronavirus: Economic Impact and Historical Context

by Jason Gunkel CFP® CFA CAP® Chief Investment Officer | February 27, 2020

After showing minor symptoms in January, the stock market has officially been sickened by the coronavirus. From February 19 to one week later on February 27, the S&P 500 stock index lost nearly 12%.

The coronavirus has been in the news for weeks but there is now more fear that governments are having trouble containing it. There are currently about 82,000 reported cases of the virus of which about 78,500 are located in mainland China. Only around 60 cases have been reported in the United States but that number is growing.

The virus will likely have a significant impact on the Chinese economy. There are currently 60 million people in China that are quarantined. Manufacturing centers around the country have been forced to temporarily close and some estimates are that the Chinese economy is operating at half of its normal capacity.

China is now the world’s second largest economy and contributes to almost 20% of the world’s economic output. It is a major supplier of goods around the world and the virus has been a major disruption to global supply chains. Some experts believe that China’s growth could decline by double digits and world growth could be flat for the first quarter.

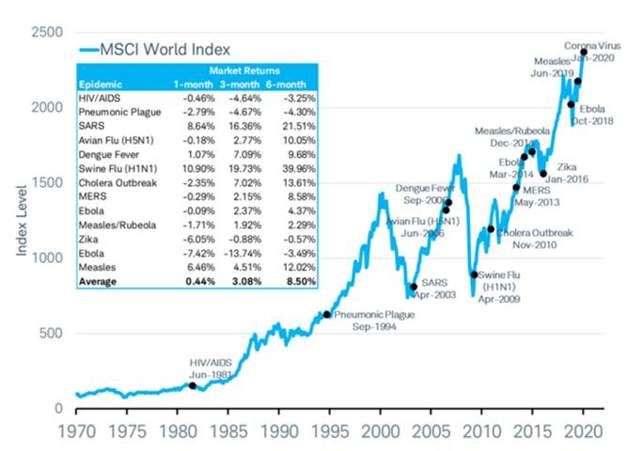

With prior health epidemics, the number of cases typically rises sharply for 8-10 weeks and then peaks. After a short-term drop in the stock market, it tends to quickly recover. The chart below shows the global stock market performance (as represented by the MSCI World Stock Index) 1, 3, and 6 months after the first case of epidemics was reported. You can see that usually after 3-6 months, the stock market has continued its upward trend.

The U.S. stock market is still in the midst of the longest bull market since World War II, which is defined by continued stock market growth without a drop of 20% or more. This streak is bound to end at some point and we have been anticipating higher market volatility this year due to the presidential election and lower margin of error for the economy. More than likely, this epidemic will be contained and its effects will be short lived like those of the past.

The Syverson Strege investment team has already taken measures to help protect client portfolios from a market correction. Rest assured that we will continue to monitor the markets and make further adjustments to our investment strategies as necessary.