Coronavirus Update: May 15, 2020

by Jason Gunkel CFP® CFA CAP® Chief Investment Officer | May 15, 2020

The stock market (as represented by the S&P 500) has had more of a toddler roller coaster ride to start the month of May. The market climbed with the news that more states across the U.S. are opening their economies, but then fell with pessimistic outlooks on the speed of recovery. The S&P 500 is down about 2% in May and down about 11% year to date.

After weeks with most of the country on lockdown, 34 states have now at least partially reopened their economies according to the New York Times. Iowa has followed this national trend of reopening with Governor Reynolds announcing on Wednesday that only bars, schools, and casinos would remain closed after May 15.

Also, on Wednesday, the Federal Reserve chair Jerome Powell issued a warning that the U.S. economy could be permanently damaged if Congress does not provide additional support to help prevent business bankruptcies and prolonged unemployment. These comments caused the S&P 500 Index to fall more than 2% that day. So far, there has been little progress in negotiations for Congress to pass additional relief measures with concerns that the federal budget deficit will already be $3.7 trillion this year.

Close to 3 million more people filed for unemployment benefits on Thursday, which pushed the eight-week total to 36.5 million and the unemployment rate likely over 15% according to the United States Department of Labor.

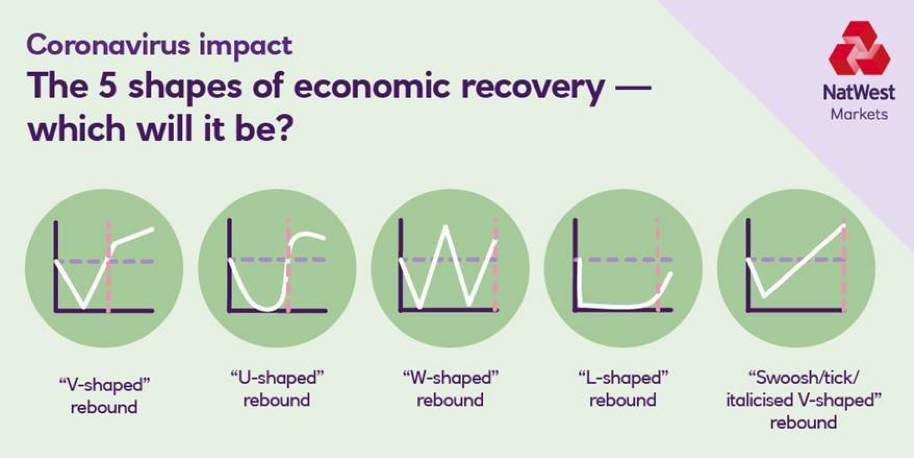

How quickly people can be rehired will likely determine the speed and “shape” of the economic recovery. This refers to the shape of a graph that shows economic growth (usually measured by GDP) over the period of a recession and subsequent recovery.

The best-case scenario is a “V” shape, which means the economy will recover about as quickly as it declined. According to one study by EY (an organization whose purpose is to build a better working world), reported by Forbes, 38% of companies believe that the current recovery will be V-shaped with the economy rebounding by the third quarter of this year.

The best-case scenario is a “V” shape, which means the economy will recover about as quickly as it declined. According to one study by EY (an organization whose purpose is to build a better working world), reported by Forbes, 38% of companies believe that the current recovery will be V-shaped with the economy rebounding by the third quarter of this year.

However, more people are now expecting a “U-shaped” recovery with 54% of companies believing this is the more likely scenario according to the EY study. The last recession the U.S. experienced in 2007 to 2009 resembled a U shape. It would mean the economy would not begin recovering until the end of 2020 or early 2021.

A “W-shaped” recovery, also known as a double-dip recession, could happen if a second outbreak of the virus forces another round of social distancing and stalls the economic recovery.

An “L-shaped” recovery is a worst-case scenario where the economy does not recover for years after a recession. Luckily, this is the least expected scenario with only 8% of companies predicting an extended recession that lasts until 2022 or longer, according to the EY study.

Finally, many corporate executives are now expecting a “swoosh-shaped” recovery which is named after the Nike company logo, according to the Wall Street Journal. This would entail a recovery that is somewhere between a “V” and “U” which has a partial bounce followed by a slow and gradual recovery. This would have the economy fully recovering around late 2021.

Our investment team will continue to monitor the projected shape of the economic recovery and its effect on the stock market. As always, we will continue to make adjustments to our investment strategies as necessary.

Please continue to stay well as we enjoy parts of our economy opening back up!