Market Update: February 2, 2022

by Jason Gunkel CFP® CFA CAP® Chief Investment Officer | February 2, 2022

It’s been a wild ride for investors so far in 2022.

It’s been a wild ride for investors so far in 2022.

After a strong finish to 2021, the stock market is off to a very slow start in 2022. The S&P 500 stock market index was down over 9% toward the end of January before finishing the month down about 5%. This was the U.S. stock market’s worst month since it dropped about 12.5% in March of 2020 near the start of the pandemic.

Investors continue to fear rising inflation will cause the Federal Reserve to raise interest rates, which in turn will slow the economy. The majority of economists polled by Reuters expect the Fed to raise rates (the Fed Funds rate that banks charge each other to borrow) three times this year to 0.75-1% by the end of the year.

Some investment companies such as Goldman Sachs are forecasting that the Fed will raise rates even more aggressively to as much as 1.5% by year end, as reported by Bloomberg.

Rising inflation has been caused in large part by disruption in the global supply chains. There is fear that the COVID-19 omicron variant could further disrupt those supply chains as it spreads throughout the world and forces temporary factory closings or workers to leave the labor market.

In addition, the markets were jittery in January with the rising tensions between Russia and Ukraine. The U.S. and NATO have threatened sanctions against Russia but have also stated that they are not considering the deployment of military forces to stop a Russian invasion. Previous incidents involving Russia, including their invasion of Ukraine in 2014, caused markets around the world to temporarily drop but then quickly recover, according to market research from Schwab. Russian companies make up about 0.4% of the global stock market so any sanctions will likely have little impact on a well-diversified portfolio.

However, January offered some positive economic news. There was good news announced in the labor markets with nearly 200,000 more jobs added to the economy in December. That pushed the unemployment rate below 4% for the first time since the pandemic began and the largest one-year drop in the rate on record. 84% of the jobs lost since the start of the pandemic have been recovered, all according to the United States Department of Labor.

Corporate profits also reflected good news. About one-third of companies reported Q4 earnings results in January and 77% of them beat earnings expectations. Earnings grew by 24% year-over-year which marked the fourth straight quarter of earnings growth over 20% for the first time in over a decade, all according to FactSet.

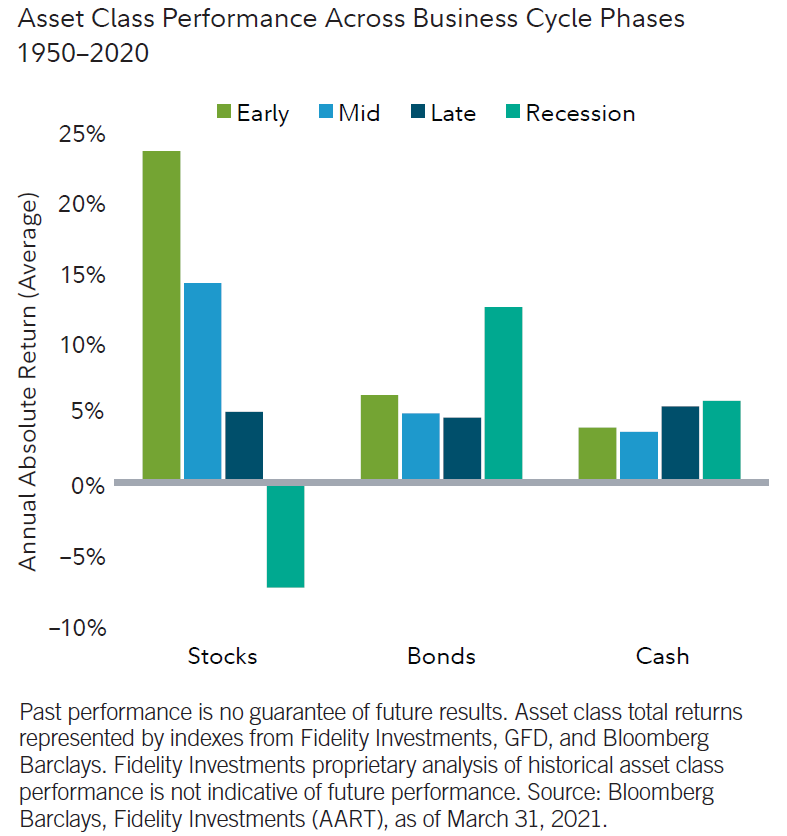

From a broader perspective, the U.S. economy has moved to the mid-cycle phase of the economic cycle after spending much of 2021 in the early-cycle phase. The early-cycle phase is generally the sharp recovery that happens after a recession with stimulative fiscal and monetary policy creating an environment for fast economic and corporate profit growth.

As the economy moves into the mid-cycle phase, economic growth is still positive but at a more moderate and slowing rate of growth. Monetary and fiscal policy is usually not as accommodating when inflation starts to rise. The stock market tends to perform well during the mid-cycle phase of the economy, but not quite as well as during the early-cycle phase.

As you can see from the chart below, the stock market has averaged returns of nearly 15% per year during the mid-cycle phase dating back to 1950. But it is also worth noting that market volatility picks up and that market corrections have taken place during this phase.

Investors tend to start shifting their stock portfolios to less sensitive sectors of the economy and more high quality stocks. But not until the economy moves into the late-cycle and recession phases of the economy does the stock market tend to really struggle to keep up with the returns of bonds and cash.

In 2021 while the economy was in the early-cycle phase, the stock market returned over 28% which was relatively close to the long-term averages for this phase. In fact, the stock market has returned over 20% in four out of the last five calendar years!

We definitely don’t expect those high of returns this year, but it is still reasonable to expect the stock market to perform relatively well during the current mid-cycle phase when economic growth and company earnings are still very strong.

If inflation returns to more normal levels by the end of the year as supply chain issues are resolved, it will go a long way towards easing the biggest worry for investors and helping the bull market continue.

If you are a Syverson Strege client, we will continue to monitor your portfolios and recommend adjustments as needed. Please call your financial planner or associate financial planner with any questions.

If you are not a client and need help with your investment decisions, please call 515-225-6000 to set up a no-obligation, complimentary, private consultation with one of our planners.